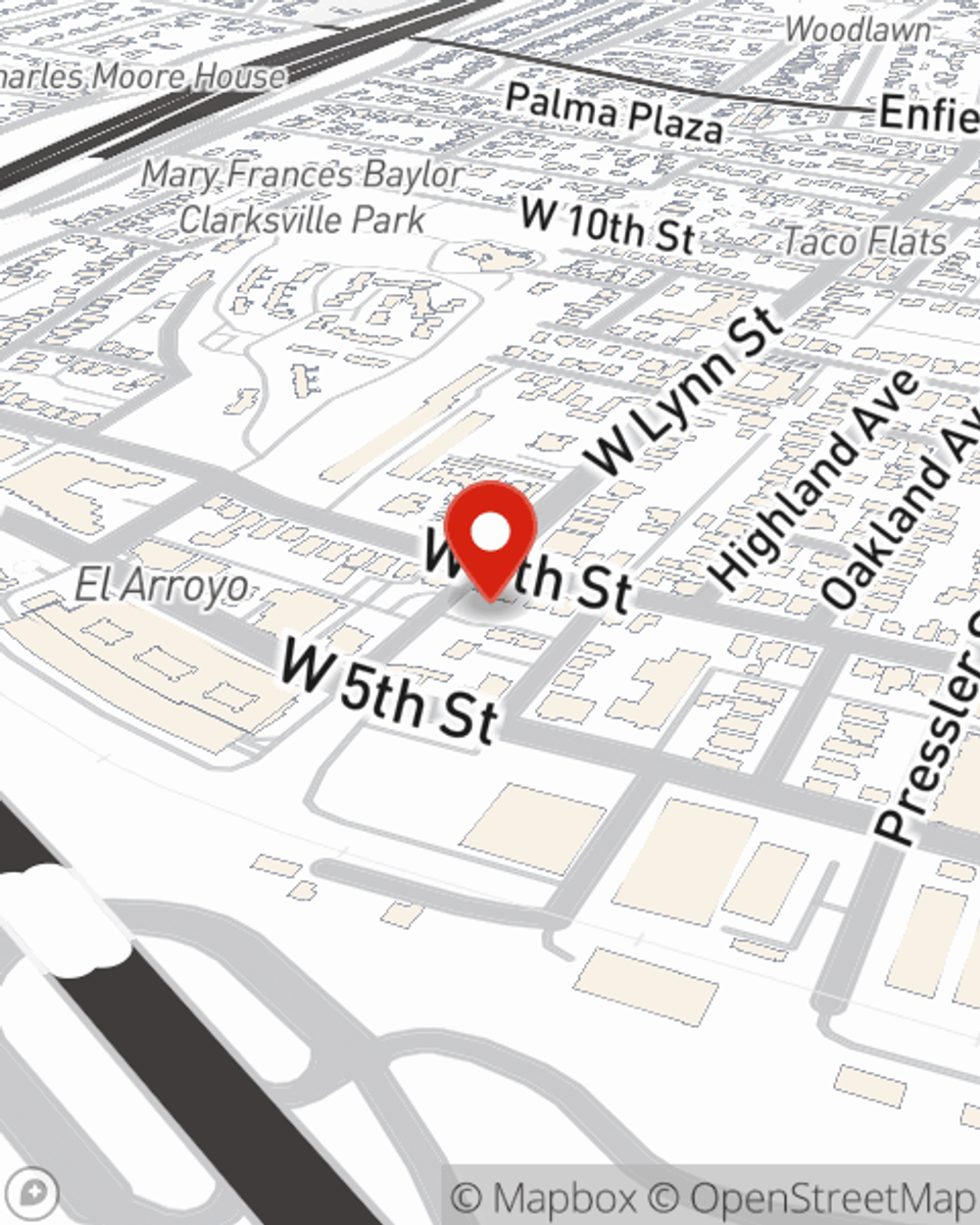

Business Insurance in and around Austin

Get your Austin business covered, right here!

This small business insurance is not risky

- Austin

- Downtown Austin

- West Lake

- Clarksville

- Terrytown

- Lakeway

- Round Rock

- Cedar Park

- Buda

- Kyle

- Travis County

- Williamson County

- Texas

- Louisiana

Coverage With State Farm Can Help Your Small Business.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Brad Herrera help you learn about excellent business insurance.

Get your Austin business covered, right here!

This small business insurance is not risky

Customizable Coverage For Your Business

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your wages, but also helps with regular payroll costs. You can also include liability, which is vital coverage protecting your business in the event of a claim or judgment against you by a consumer.

Visit State Farm agent Brad Herrera today to learn more about how a State Farm small business policy can ease your worries about the future here in Austin, TX.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Brad Herrera

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.